The next downturn may be different than the last. Look to commercial real estate for clues about the direction of the economy.

The U.S. gross domestic product contracted in the first quarter by 1.5%. The stock market has been tumbling. Inflation is stubbornly high. The Federal Reserve plans to continue raising interest rates. Pending home sales have fallen for six straight months and are now trending slightly below 2019 levels. The economy, in short, is on the verge of a recession.

Yet, it will not be a straightforward recession. Despite hiring freezes at tech firms and recent job cuts among mortgage lenders as refinance business dries up, the bigger problem for the economy is not a lack of jobs but rather a shortage of workers. Statistically, there are two job openings for each unemployed person. That’s why wages are up an average of 5.5% from a year ago, to nearly $32 per hour nationwide. However, inflation is gobbling the increase up with an 8% rise in the cost of living.

A recession typically means bad news for commercial real estate. But this time, the condition of the commercial market may be an indicator about the direction of the overall economy. Demand for apartments and single-family rentals is booming because of consistent job gains and affordability challenges in the For Sale market. Low vacancy rates, though, have pushed up average rents significantly this year. Demand for warehouse space has surged as retailers look to avoid supply-chain disruptions. The retail sector is recovering, with more fitness gyms, nail salons, and restaurants popping up in the suburbs. Hotel bookings, air travel, and park attendance, are above pre-pandemic levels. Consumer spending in the GDP calculation was up a solid 3.1%, even after adjusting for inflation. Weak trade numbers—exports were down and imports were up—brought the fall in GDP. Homeowners, after all, have accumulated sizable housing wealth: $75,100 in the last two years and $155,400 over the past five years. The stock market is going through a painful correction, though the broad S&P 500 index is up by 70% from five years ago. That’s why total net household wealth has essentially doubled from 10 years ago.

The office market is another story. There’s no strong desire on the part of employees to return to their downtown offices. Google’s GPS tracker shows robust movement just about everywhere except in office locations during work hours. Some form of working from home will be a permanent feature of the post–COVID-19 economy. This is also the reason traffic jams are happening more often on weekends than on weekdays. Welcome to the new normal.

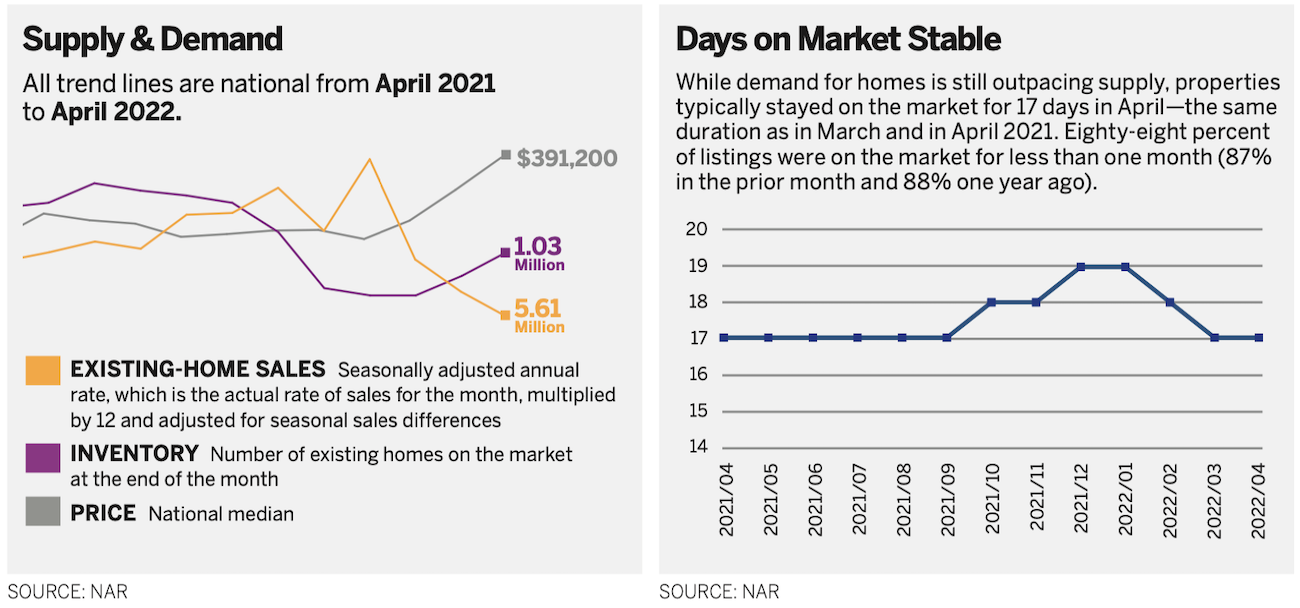

Housing Inventory Edges Up

Total housing inventory at the end of April 2022 amounted to 1.03 million units, up 10.8% from March but down 10.4% from one year ago. At the current sales pace, there was a 2.2-month supply, up from 1.9 months in March and down from 2.3 months in April 2021.

No comments:

Post a Comment