The new 2021 Generational Trends Report found that one in five millennial buyers (20%) and boomers (22%) are unmarried. And Gen Z is now 2% of all buyers and growing.

Multigenerational homes’ popularity has only increased over the last year, as a rising number of homebuyers purchased larger residences compared to prior years, including millennials who made up the largest share of homebuyers (37%). The numbers come from the National Association of Realtors® (NAR) latest study on homebuyer characteristics, the 2021 Home Buyers and Sellers Generational TrendsOpens in new tab. report.

As a group, millennials have bought the most homes since NAR’s 2014 report. Of those millennial buyers in the latest report, 82% of younger millennials and 48% of older millennials were first-time homebuyers – more than other age groups.

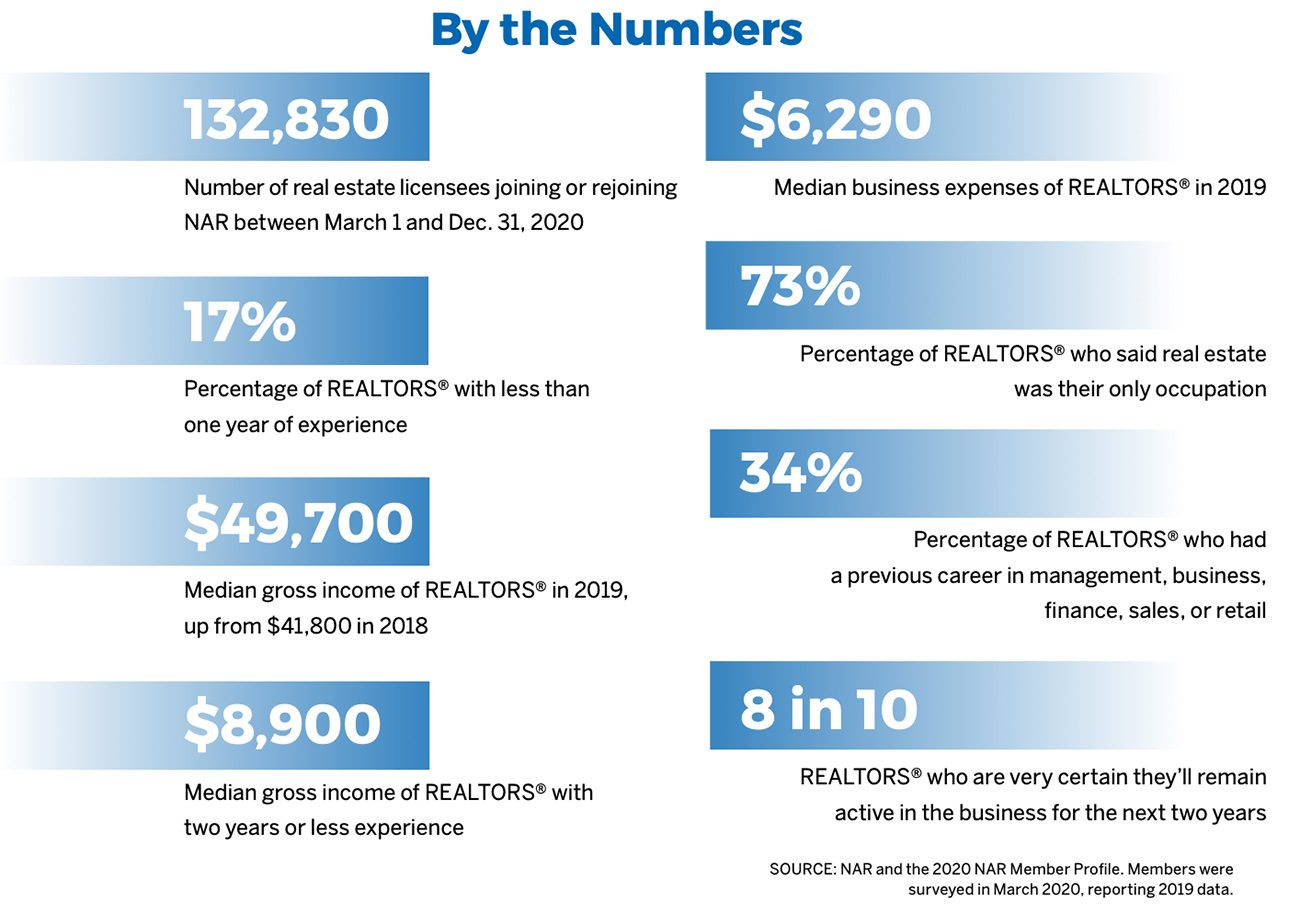

Realtors® as part of the process: Out of all buyers, 88% cited a real estate agent as an information source they used during their home search, but that share rises to 91% among younger millennial buyers ages 22 to 30. Two percent of all buyers and sellers were from Generation Z.

“Buyers used all tools available to them – whether it be a mobile device, yard sign or an online video – but at some point, nearly all buyers turned to an experienced agent to assist with the transaction,” says Lautz. “This is especially true among younger millennial consumers as they are likely first-time buyers and need help navigating the market and all steps involved in the process.”

Buyers from all generations – more than half (51%) – primarily wanted an agent’s help to find the right home to buy. Homebuyers also called on agents to help with brokering the terms of their sale and to aid with price negotiations. According to the report, the oldest and youngest age groups, those 66 and older as well as those ages 22 to 30, were more likely to want their agent’s assistance with paperwork.

In terms of selling – consistent across all age groups – nine out of 10 home sellers worked with an agent to sell their home.

“Realtors® continue to be an integral part of both the homebuying and the home selling process,” says NAR President Charlie Oppler. “Buyers and sellers should understand that we can assist with every part of the real estate transaction, from finding or listing a property, securing a loan and sorting through the exhaustive paperwork.”

Multigenerational homes: During the past year, 18% of homebuyers age 41 to 65 purchased a multigenerational home – a home that will house adult siblings, adult children, parents or grandparents.

“There are a variety of reasons why large families and extended families are opting to live together, one of which is that it’s a great way to save money,” says Jessica Lautz, NAR’s vice president of demographics and behavioral insights. “Also, in light of the pandemic, many grandparents and older relatives found that being under a single roof – quarantining with family rather than away – worked out better for them.”

Homebuyers age 75 to 95 were second most likely to purchase a multigenerational home, and also most likely to purchase senior-related housing, at 27%.

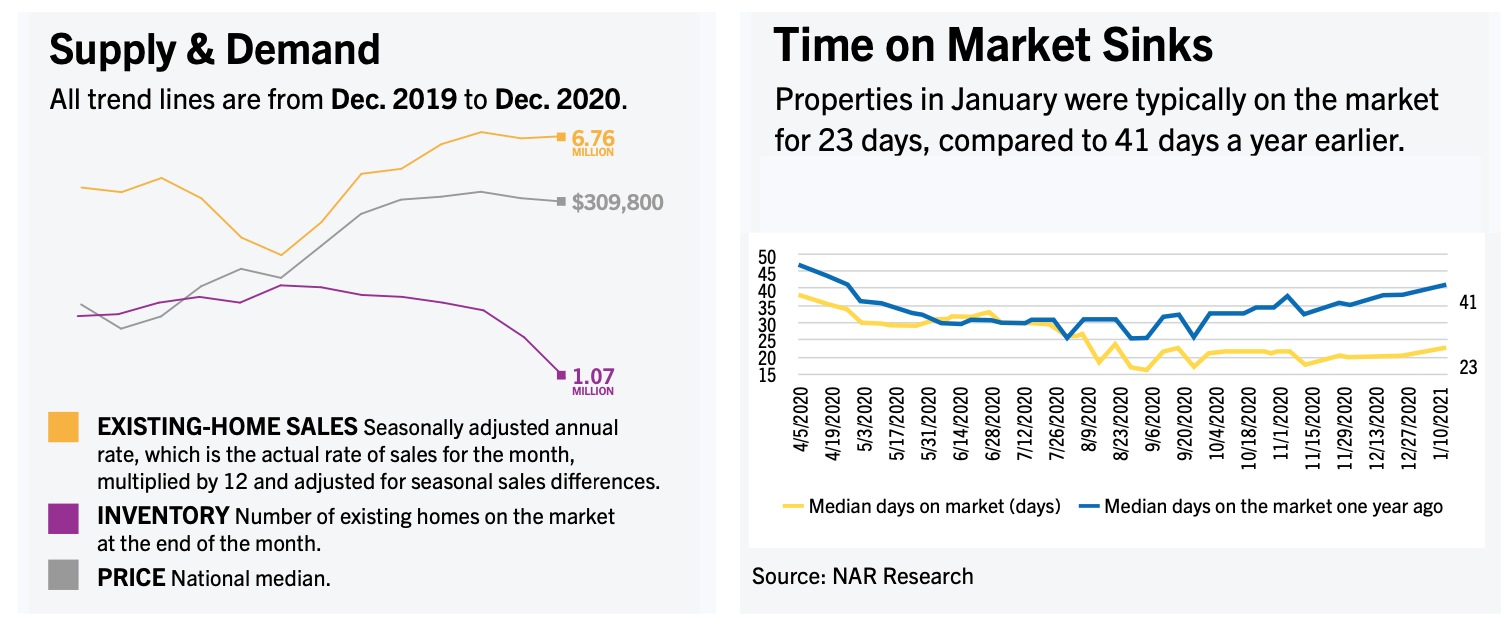

With alarmingly low inventory levels in recent years – even dropping to record-low levels last year – a number of would-be homebuyers had difficulties finding adequate housing options. Nearly six in 10 homebuyers between the ages of 22 to 40 said finding the right property was the most challenging step in the buying process. More than half of all buyers (53%) said it was the most difficult step.

Younger millennials: Twenty-eight percent of homebuyers ages 22 to 30 – younger millennial buyers – lived with parents, relatives or friends before purchasing, the most of any generation. Living with family first tends to provide flexibility in saving for a downpayment and finding a home, given the low housing inventory.

In addition, 20% of homebuyers in the younger millennials group weren’t married, a decline from 21% from a year ago. But it wasn’t just millennials buying a home sans spouse: 22% of homebuyers between the ages of 66 and 74 were single women.

“Single women remain a large buying force,” said Lautz. “A number of divorced women and those who were recently widowed purchased a home without the help of a spouse or roommate.”

Buyer characteristics: Overall, 19% of older boomers – buyers between the ages of 66 and 74 – and 18% of Generation Xers (ages 41 to 55) were most likely to purchase a new home to prevent having to do renovations or avoid plumbing or electricity problems, and these buyers prioritized the ability to choose and customize design features.

Seventeen percent of buyers who are part of the silent generation – those between the ages of 75 to 95 – purchased newly-built homes. These buyers were least likely to compromise in their home search and least likely to purchase a detached single-family home.

Location: As is always the case in real estate, location was an important component among buyers: 54% of homes purchased by older millennials (age 31 to 40) were in a suburb or subdivision. Out of this age group, 69% said the quality of a neighborhood influenced their selection. That sentiment was shared by buyers ages 22 to 30 (65%). Among the 22-to-30 age bracket, 74% cited “convenience to workplace,” as imperative.

“The younger millennials overwhelmingly answered that they prefer to live closer to work, as many don’t want a long commute, and this was evident in their buying habits,” says Lautz. “Additionally, both of these groups also placed a high value on being close to family and friends, as 57% said that dynamic factored into what neighborhood they ultimately chose.”

Older boomers and those in the silent generation were similarly heavily influenced by a desire to be close to family and friends: 47% of both generations cited it as a factor in neighborhood selection.

Older boomers (35%) and the silent generation (36%) also valued their neighborhood being close to areas in which they could shop, and both groups (28% and 31%, respectively) also said that proximity to a health care facility was an influential factor.

Reasons for selling: Among all sellers, the most commonly cited reason for wanting to sell their residence was a desire to move closer to friends and family (15%), followed by a home that had become too small (14%) and a change in their family situation (12%).

Technology: In the midst of the pandemic, the usefulness of virtual tours skyrocketed, especially among 22- to 40-year-old buyers.

“Homebuying aside, this segment of the population was already accustomed to doing research online,” said Lautz. “So, to see them really embrace virtual tours and virtual open houses was a given, nonetheless, real estate agents are the top information source, and the data shows these buyers ultimately used agents to purchase a home.”

Home seller characteristics: Baby boomers made up the largest share of home sellers at 43%. Younger sellers, those aged 55 and younger, often sold a home so they could upgrade to a larger and more expensive home. Sellers 56 years and older more often purchased a similarly-sized home, but one that was less expensive than the home they sold.

Overall, sellers stayed in their previous home for a median of 10 years before selling, though that varied by age group: A median of six years among sellers ages 31 to 40 and 16 years among sellers 66 and older.

Recently sold homes were generally on the market for a median of three weeks.

Lautz says the tight inventory of for-sale properties contributed to the short listing time. It also helped sellers recoup more money on their transactions – a median of $66,000 in equity from their sale.