Inflation and rising mortgage rates will add pressure to real estate markets.

Inflation is edging higher, which doesn’t bode well for interest rates. The consumer price index rose 1.7% year over year in February after having sunk to nearly zero in the early months of the pandemic. The increase was driven by higher prices for used cars, utilities, meat, and health care. In addition, rental housing costs rose 1.5%. And while February home prices rose 15% for the year, they’re not in the index.

Besides causing consumer irritation, inflation can push up mortgage rates. The Federal Reserve recently said it won’t raise interest rates until at least 2023. No matter, mortgage rates will still climb.

Millennials have never experienced 1970s-era inflation, but they could get their first taste. Then, inflation averaged 7.1% annually, topping out at 11% in 1979—the same rate as the 30-year fixed mortgage. The primary cause? Excessive printing of money. And something similar is occurring now.

The Fed prioritized reducing unemployment and keeping inflation under 2%. But its goals have loosened, and inflation as high as 5% may be tolerated.

So why does inflation lead to higher mortgage rates? Lenders don’t want to issue loans at very low rates, knowing that, if they did, their returns would fall. While the Fed has said it won’t change very short-term rates, it can’t control long-term rates, which can easily rise if lenders get nervous about inflation. For now, mortgage rates are still very attractive at around 3%.

One component to monitor is housing rents, which, before the pandemic, were rising by 3.8% annually. Rental demand softened due to the pandemic, but now that jobs are returning, vacancies are falling and rent increases may again approach 4%. As a result, inflation will end the year above 2%. Higher inflation looks likely in 2022 and beyond. As mortgage rates head higher, becoming a first-time homeowner will get tougher. But current owners have fewer worries. In the 1970s, the median home price rose from $23,000 to $55,700, an average annual gain of 9.9%—and a reminder of the wealth-building potential of homeownership.

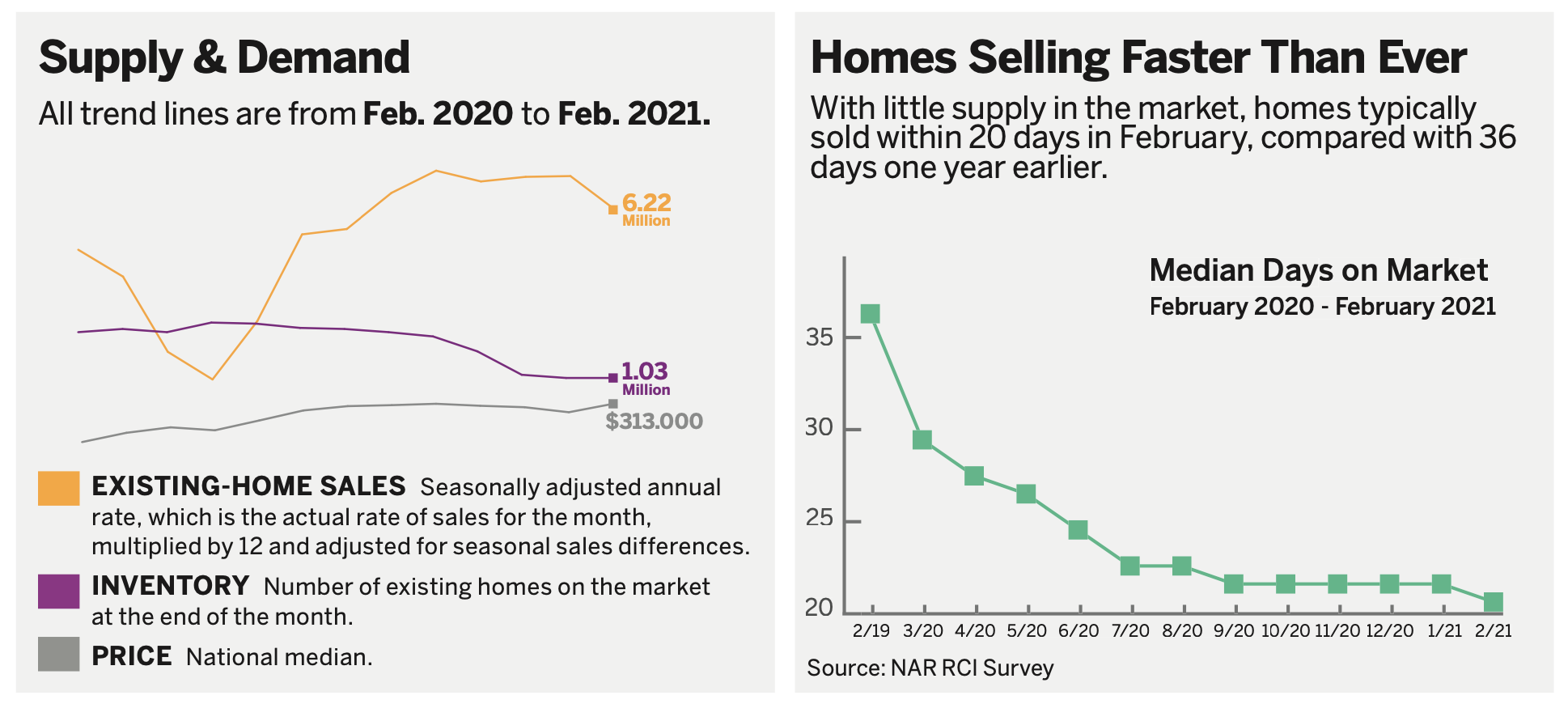

Housing Inventory Remains at Record Low

Housing inventory remained at a record low of 1.03 million units at the end of February, down by 29.5% year over year, which is a record decline. Meanwhile, homes are practically flying off the shelves.

No comments:

Post a Comment